Narrow Down Your Car Options with Our Online Calculator

When purchasing a new or used car, a repayment estimate is one of the most valuable pieces of information you can acquire. Get informed by using our online loan calculator now!

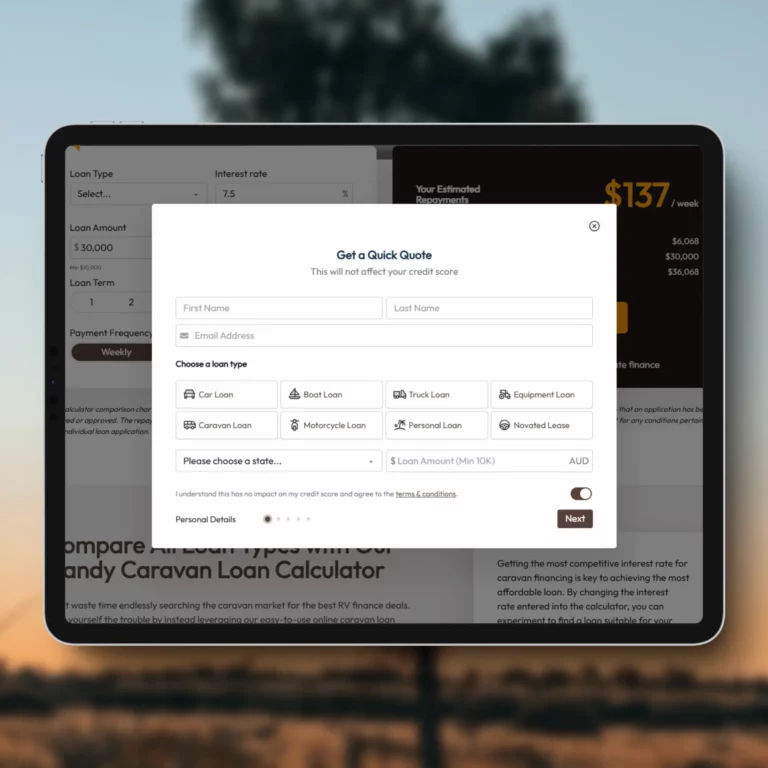

Versatile and Easy to Use - Our Personal and Commercial Car Loan Calculator

It’s easy to generate a shortlist of motor vehicles that you want to buy, but analysing whether you can actually afford them – that’s a bit more complicated. By using our online car loan calculator, this process is made far more simple and efficient. Create a shortlist of your ideal commercial or personal vehicles and use the device to weed out the ones that exceed your budget. Our online car loan calculator enables you to compare and consider your car options quickly and easily.

To use the device, input the interest rate for your preferred credit facility. Rates will vary between credit facilities and across the lending market, so ensure you are using our best rates as a guide. We source our rates from 80+ banks and lenders, enabling us to cover a large portion of the market and present the most affordable loan solutions to each of our borrowers.

You can also contact us for a rate specific to your financial situation and profile.

Your very own dedicated broker will scan the market to find the best rate from the most suitable lender for your financial situation. Let us match your borrowing profile with the lender whose approval criteria is best suited to you. Use the highly competitive rate generated for you to compare a variety of makes and models of motor vehicle via our online car loan calculator to find the right option for you.

- Calculate secured and unsecured personal car loans.

- Estimate and compare commercial credit facilities.

- Contact our brokers for a rate specific to your financial profile.

Read more...

While our estimation device is a major drawcard for borrowers seeking a personal or commercial car loan, another significant advantage of Easy Car Finance is our ability to find the best motor vehicle financing interest rates available on the market. Covering the market without the help of a broker can be a difficult and time-consuming task – by engaging the experts at Easy you’ll receive access to over 80 on and off-market banks and lenders.

Wherever you are and whenever you choose – access our powerful motor vehicle repayment estimator online. Use the device to calculate, consider and compare your car financing options before committing to a purchase. Assess your ideal options by generating estimates for each model in your shortlist and weeding out those that exceed your budget.

Our estimation device generates motor vehicle repayment predictions quickly and easily. Save time and eliminate inconvenience by calculating your repayment estimate today!

Unlock Vital Information - the Power of Car Loan Repayment Estimates

For a high level of convenience when searching for a new or used car, achieve a loan repayment estimate via our online car finance calculator. It’s a highly versatile device that offers beneficial outcomes for borrowers eager to stick to their budget. Most buyers will use our calculator to quickly change vehicle prices into manageable monthly repayments. To do this, simply enter the price of the vehicle as the loan amount, plus the interest rate and term, and click calculate. Don’t forget to subtract the deposit or trade-in amount first!

As a buyer, you know how much you want to commit each month to repay your car loan. But do you know how many months or years it will take to completely pay off the loan with those monthly repayments?

To quickly and easily work that out, use our automatic estimation device. Just enter the total amount you require, as well as the interest rate for the relevant credit product, and the loan term you are willing to commit to. Sit back while the device presents your repayment estimate. If the amount is too high or too low, play around with the entered figures until you find a repayment amount that works for you.

The repayment estimator is programmed to perform a range of functions. It specifically enables car buyers to customise, evaluate, compare and prepare their car loan based on their financing plans and preferences. If you’re seeking a commercial car loan, vary the balloon payment and term to harness a monthly repayment commitment that works for your cash flow.

Assess each car on your shortlist by generating your likely weekly, fortnightly or monthly repayments via our online car loan calculator. By using the estimation device, you can easily narrow down your shortlist to find the cars that are within your budget. If you’re considering including accessories or optional packs, make sure you add the additional purchase cost to the total to see how much extra those options will be in repayments.

Buyers that don’t plan their car purchase prior to walking into a motor vehicle dealership will often feel overwhelmed. That’s why using our car loan calculator is so invaluable. Feel confident in what you can afford and the repayment amount you will be committing to by using our calculation device. You can use it prior to visiting the dealership or while you’re there for real-time decision making.

Get immediate conversions – price tag to repayment estimates

For a high level of convenience when searching for a new or used car, achieve a loan repayment estimate via our online car finance calculator. It’s a highly versatile device that offers beneficial outcomes for borrowers eager to stick to their budget. Most buyers will use our calculator to quickly change vehicle prices into manageable monthly repayments. To do this, simply enter the price of the vehicle as the loan amount, plus the interest rate and term, and click calculate. Don’t forget to subtract the deposit or trade-in amount first!

Set your preferred loan term and repayment frequency

As a buyer, you know how much you want to commit each month to repay your car loan. But do you know how many months or years it will take to completely pay off the loan with those monthly repayments?

To quickly and easily work that out, use our automatic estimation device. Just enter the total amount you require, as well as the interest rate for the relevant credit product, and the loan term you are willing to commit to. Sit back while the device presents your repayment estimate. If the amount is too high or too low, play around with the entered figures until you find a repayment amount that works for you.

Structure business financing – balloons and residuals

The repayment estimator is programmed to perform a range of functions. It specifically enables car buyers to customise, evaluate, compare and prepare their car loan based on their financing plans and preferences. If you’re seeking a commercial car loan, vary the balloon payment and term to harness a monthly repayment commitment that works for your cash flow.

Compare repayments on different car makes and models

Assess each car on your shortlist by generating your likely weekly, fortnightly or monthly repayments via our online car loan calculator. By using the estimation device, you can easily narrow down your shortlist to find the cars that are within your budget. If you’re considering including accessories or optional packs, make sure you add the additional purchase cost to the total to see how much extra those options will be in repayments.

Feel confident in your final purchasing decision

Buyers that don’t plan their car purchase prior to walking into a motor vehicle dealership will often feel overwhelmed. That’s why using our car loan calculator is so invaluable. Feel confident in what you can afford and the repayment amount you will be committing to by using our calculation device. You can use it prior to visiting the dealership or while you’re there for real-time decision making.

Access Our Online Car Loan Calculator Anywhere in Australia

- No hidden fees or surprises, just valuable repayment estimates.

- Simplify the car buying process with instant comparisons.

- Secure competitive interest rates from trusted Australian lenders.

- Real-time finance quotes from home, showrooms, & dealerships.

- Easy 24/7 access to the device from anywhere.

Optimise Use of the Online Car Loan Calculator in 3 Easy Steps

To get the most out of your estimate, it’s important to understand how to efficiently and accurately use the online device. The process is simple and only requires you to enter three amounts for your specific motor vehicle.

The first amount you will need to enter is how much you require for the loan – that is, the full purchase price of the car minus any deposit or trade-in value.

The second amount you will need to enter is the interest rate. We advise using our latest best interest rates as a guide for the purpose of obtaining a quick estimate. Be mindful that your actual rate may vary from these numbers based on your specific financial profile and credit score. Rates also vary depending on the finance product you select – commercial or private.

The third amount you will need to enter is the term you wish to repay the loan over. We offer terms on motor vehicle financing for 1 to 7 years. We recommend opting for a repayment term that matches your ownership cycle to ensure no funds are outstanding when it comes time to sell or trade-in the vehicle.

After completing the three fields, click CALCULATE. You will receive a monthly repayment estimate based on the three amounts you have entered. To compare lenders and vehicles, vary the interest rates and loan amounts respectively. After you have established your preferences and achieved a repayment estimate that works for you, give our expert brokers a call for a firmed up quote.

- Quickly switch between various financing rates and terms.

- Find the most cost-effective car loan choice for you.

- See how varying the loan amount influences your predicted repayments.

Request Quick Car Financing Quotes - Fast Application Process

After using the car loan calculator, ask yourself – are the repayment estimates what you expected? Are you ready to move forward in obtaining motor vehicle financing? If the answer is yes, get in touch with us online or by phone and we’ll provide you with an accurate no-obligation quote.

All our financing quotes are sourced from across our extensive panel of 80+ banks and lenders. With so many financiers at our fingertips, we know just where to find the best possible rates and terms for every borrower that comes our way. Let us negotiate with lenders and process your application quickly and efficiently to get you on the road as soon as possible.

Contact us today to start the process and we’ll provide approval 24 hours later!

The Most Frequently Asked Questions

What is the car loan calculator and how will it help me?

Our car loan calculator is a highly valuable online tool to help borrowers estimate their vehicle loan repayments prior to committing to a purchase. By entering details like the loan amount, interest rate and loan term, the device calculates your weekly, fortnightly, or monthly repayment amount. The device is helpful for borrowers due to its ability to compare different car models and loan options to find the best fit for varying budgets and preferences.

How do I use the online car loan calculator?

Using our online car loan calculator is simple. Just enter three key amounts: the loan amount, the interest rate, and the loan term. After this, click calculate and the device will provide you with an estimate of your repayments based on these details. Adjust the numbers to compare vehicles and credit facilities.

Why should I use a car loan calculator before buying a car?

The car loan calculator is valuable for helping borrowers avoid any surprises in the car loan repayments. By using the device, you will know your payment commitments prior to purchasing a car, whether you choose a personal or commercial loan. Vary the entered amounts to find the best fit for your financial situation – rates, terms, amounts.

When should I start using the car loan calculator?

We recommend using the car loan calculator as a first step when thinking about purchasing a new or used car. By getting an early estimate of your potential loan repayments, you can set a budget and focus only on the vehicles that fit within your price range.

Where can I access the car loan calculator?

The car loan calculator is accessible 24/7 from anywhere in Australia. Access it at home, at your office, in a dealership, or any other location with internet connection.

What types of car loans can I calculate with this tool?

Use the car loan calculator for both personal and commercial car loans. The device is versatile and can assess a wide range of financing options, whether you’re looking at a regular car purchase or a business vehicle loan. Adjust the figures entered into the device to find a repayment plan that works for you.

How can I be sure the rates I see are competitive?

Our best rates should be used as a guide when comparing your car options via the calculator. These rates are sourced from over 80 banks and lenders across the car financing market and can be relied on for comparing different loan options. For a rate specific to your financial situation, give one of our brokers a call and we can provide a specifically tailored rate that reflects your individual circumstances.

Why should I choose Easy Car Finance for my car loan?

We simplify the car financing process. Our access to 80+ banks and lenders is highly valuable and enables our expert brokers to match each borrower’s profile with the best lender for their specific car loan requirements. By coming to Easy Car Finance, you’ll receive streamlined assistance to ensure you find the right financing solution for you.

How do I know if I can afford a car loan after using the calculator?

By inputting your preferred loan amount, rate and term into the car loan calculator, you’ll receive a repayment estimate for the make and model of car you want to purchase. If the amount provided is outside your monthly budget, you can adjust the variables of the calculator to try and keep it within your means. By testing different options, you can find a repayment amount that fits your budget and does not overstretch your finances.

What do I do after receiving my car loan estimate?

After receiving your car loan estimate, you can either move forward with your loan application or continue tweaking the device to find a better fit. Once you are satisfied with the estimate, give one of our brokers a call and we’ll provide you with a more accurate, no-obligation quote based on your exact financial profile. If you’re happy with the final quote, we will assist you through our quick and easy application and approval process.

Let Easy Car Finance simplify the process by taking care of the complicated steps for you